An equipment lease agreement is a contract in which the owner of the equipment, the lessor, gives the lessee permission to use the equipment for a certain amount of time in exchange for regular payments. The leased item could be a car, a factory machine, or any other piece of equipment.

Making a comprehensive and effective equipment lease agreement is essential because it protects everyone involved for the length of the lease. Even though many landlords start with standard lease agreements, all parties can change the language and terms until the lease is signed, which becomes a legally binding document.

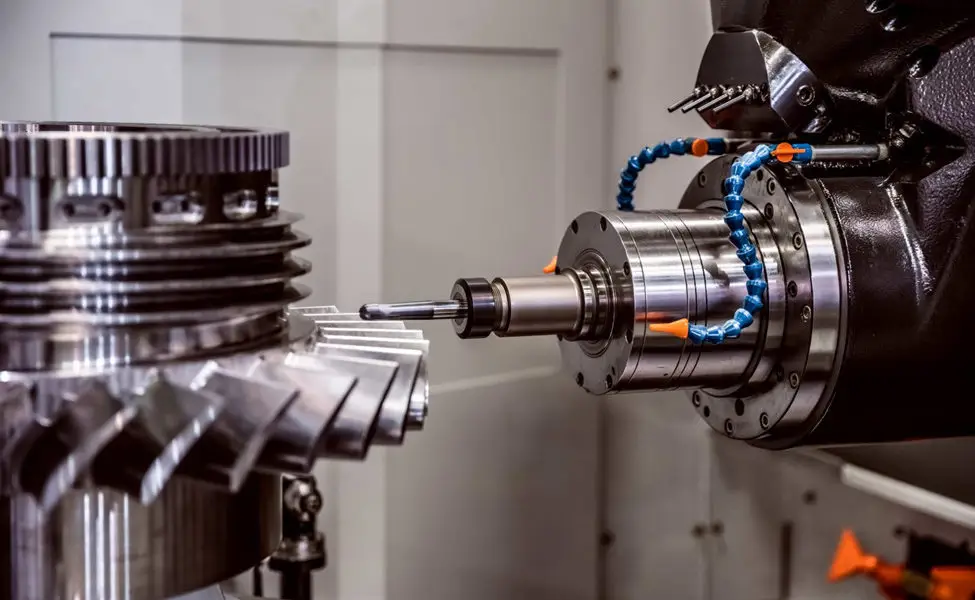

Thousands of equipment leasing companies rent equipment to other businesses for regular payments. Most companies don’t have the money to buy big machines that can cost millions or billions of dollars, so they prefer to rent them for a specific time. Some of the equipment in high demand to lease is high-tech, like diagnostic tools, gadgets for communication, and computers.

Aspects Of An Equipment Lease Agreement

In an equipment lease agreement, specific terms make up the contract. Some of these terms could be:

Lease Duration

The lease length will depend on what the company needs and how much the equipment costs.

Having to Pay Taxes

Depending on the type of lease, the person renting the equipment may have to pay for things like taxes. If the lessee knows how much tax they must pay for each type of lease, they can avoid getting stuck with unexpected costs.

Financial Terms

In the equipment lease agreement, there are things like payment schedules.

Options for Lease Renewal

Lessee renewal options tell the lessee how to renew the lease when the lease period is over.

Value Of Equipment In The Market

Knowing the market value helps the person renting the equipment figure out how much insurance to buy in case the equipment gets lost or broken.

Types of Equipment Leases

There are two main types of equipment leases, which are:

Finance Lease or Capital Lease

Usually, a finance lease is a full-pay-out contract. This means that the total amount of the rentals cover the full cost of the equipment plus any interest that has been added. This kind of contract usually lasts for a long time, and the person who uses the equipment must keep it in good shape and take care of it. However, once the lease is over, at the end of the minimum lease term, you may be able to buy the property. An example is an aircraft financing lease.

Operating Lease

Most operating leases are short-term and can be ended before the lease is up. Businesses that only want to use the equipment for a short time or want to replace it at the end of the lease often lease it. A lessee can cancel the equipment lease agreement at any time before the end of the lease period as long as they give notice, but they usually have to pay a fee.

Finance Lease vs. Operating Lease

A company can rent and use an asset with operating and finance leases. But the main difference is that the person who rents the item gives up ownership of it in a finance lease. For accounting purposes, the lessee doesn’t get any of the benefits of ownership with an operating lease.

Here Are The Key Differences:

Title

At the end of the lease term in a finance lease agreement, the property is turned over to the lessee. In an operating lease, on the other hand, the lessor keeps ownership of the property during and after the lease term.

Costs Of Running And Managing

In an operating lease, all of the costs of running the equipment are included in the monthly payment for the length of the lease and the number of miles it can be driven. Most of the time, these are not included in a finance lease, so the lessee may have to deal with more paperwork and price changes.

Balloon Amount/Residual Amount

In a finance lease, the lessee has the option to buy the property or equipment at a certain price, called the “balloon” or “residual.” But the lessee doesn’t have this choice with an operating lease. Therefore, specific asset guidelines are used when figuring out the balloon/residual on a finance lease. There are multiple equipment lease calculators available too.

Which is Better: Financing vs. Operating Lease?

Often, the answer to this question depends on what you’re going through.

With an operating lease agreement, the end user doesn’t have to do as much paperwork and can hand the car back at the end while making one simple monthly payment. These are usually good for businesses that run at least a few types of equipment like automobiles because they save time on paperwork.

On the other hand, a finance lease will require more paperwork and, depending on the type of asset and the rules for the particular balloon, may increase the resale risk for the lessee because the balloon amount must be paid off by the end of the term.

Lessees in an operating lease don’t have to worry about the same risks that lessees in a finance lease do. In an operating lease, the lessee only has the right to use the asset they are renting. This means that the person who owns the asset keeps all of the risks and benefits that come with it. The lessor is also responsible for any costs related to maintenance or repairs.

The Bottom Line

Companies often use both capital and operating leases, so it’s helpful to know how each type of lease is handled in terms of accounting and taxes for both the lessor and the lessee. Each kind of lease has its good points. Depending on the company’s needs and tax situation, they may choose one or the other or use both for different types of assets.